The size of the Turkish information and communication technologies sector exceeded 150 billion liras

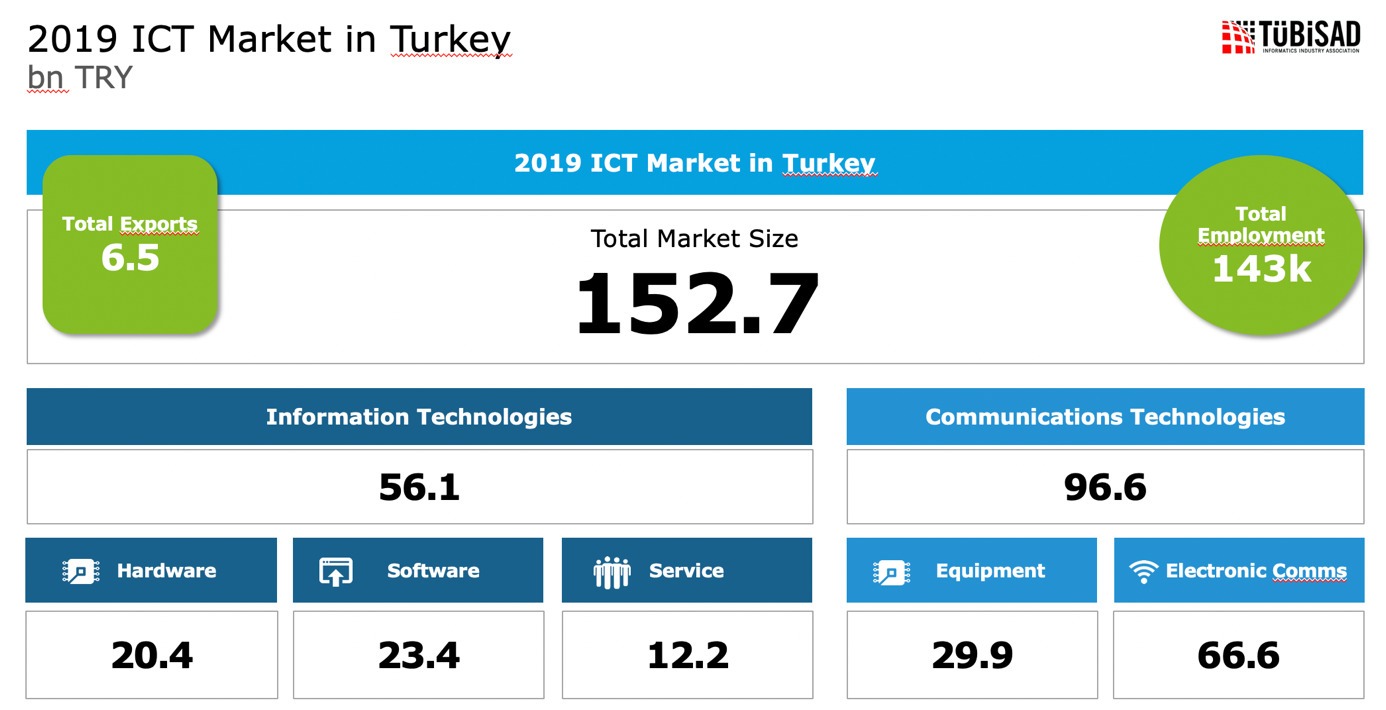

TÜBİSAD announced "Information and Communication Technologies Sector 2019 Market Data". According to this data, the sector reached the basis of TL the volume of 152.7 billion TL, with a growth of 14 percent compared to the previous year on . The sector's export, which increased its employment to 143 thousand people, was realized as 6.5 billion TL.

Informatics Industry Association (TÜBİSAD) announced the "Information and Communication Technology Sector Market Data" of 2019 at a meeting organized digitally. TÜBİSAD Chairperson Kübra Erman Karaca gave the opening speech at the meeting, TÜBİSAD Information Center Commission Chairman Levent Kızıltan and Deloitte Turkey Partner Hakan Göl made statements about the report. A panel titled "Information and Communication Technologies Sector 2020 Assessment" was also organized at the event. In the panel moderated by Chairman of TÜBİSAD Information Center Commission Levent Kızıltan, speakers CONTEXT Turkey Country Manager Erol Kuseyri and TÜBİSAD Board Members Atilla Kayalıoğlu, Mehmet Ali Akarca, Burak Aydin and Aslı Derbent shared their views on the sector’s performance in 2019 and its future.

Support for the IT sector is necessary to adapt to the new normal

TÜBİSAD Chairperson Kübra Erman Karaca said: "Despite the slowdown observed for some time at the growth rate of our economy and a period of conjunctive uncertainties prevailing, the information and communication technologies sector in Turkey continued to grow in 2019 on the basis of Turkish Lira. However, as a result of the COVID-19 outbreak, I think it would be healthier to evaluate the 2019 data based on the 'start over' conditions faced by both the world and the industry. In light of the expectations of constriction in the global economy and the potential contributions of the information and communication technology sector to the 'new normal' period, we anticipate that the rapid and efficient increase of investments for our sector will contribute to the sustainable growth and development of our country's economy more than ever before. Unfortunately, we do not see the growth performance of our sector on a dollar basis, which we have seen on Turkish Lira. An ongoing trend of constriction since 2017 is an issue that we need to focus on, especially during this period we experience. Despite the growth performance shown by our sector on the basis of Turkish Lira, we should also express that we need to reach much higher growth rates when considering the annual inflation rate of 11.8 percent and the current potential of our sector. The fact that the information and communication technology sector is the locomotive of economic growth is once again revealed, given the figures. It is clear that when we support this locomotive with rational investments and policies that pave the way for entrepreneurship, the contribution to the growth rate of our country and global competitiveness will increase. Of course, the COVID-19 outbreak made this situation clearer. In terms of the extraordinary working conditions that today brings, the telecommunications sector has the potential to develop with its remote connection and dominance of individual segments, while the information technology sector may be adversely affected by the process due to the decrease of investments and the slowing of the need for services.

In order to avoid negative effects, the awareness of rising digital transformation in all sectors needs to be expanded. In addition, it is vital that the software and informatics sector benefit from all the supports our country will apply to other negatively affected sectors."

The shrinkage in dollar basis indicates that our country invests less in technology

TÜBİSAD Information Center Commission Chairman Levent Kızıltan shared the following views on the report's findings: "The growth of our technocities is very gratifying. They show the high potential of our sector both in terms of the number of companies and the number of employees. We see that financial sector software are the components that attract the most attention. Here, the fact that bank technology units are incorporated and included in the R&D Center evaluations makes the difference. Because our technology hardware production and technology infrastructure software (databases-operating systems-analytical tools, middleware software, etc.) production is already limited, these products continue to be included in a large part of the software and services that look like local production. Therefore, the shrinking of the market in the US dollar basis actually indicates that our country has invested less in technology since 2018 compared to the past."

Deloitte Turkey Partner Hakan Göl added: "We think there are great opportunities for our country in the Global Information and Communication Market, which is close to 5 trillion dollars. We can make our human resources competitive, especially in the areas of software and services where employment and added value are high, and we can show presence in large markets, especially in America. One thing that should not be forgotten when turning to international markets is that there should be a dynamic domestic market for sustainable export success."

2019 Information and Communication Sector Market Size

According to information provided by Hakan Göl, who made a statement on behalf of TÜBİSAD, the sizes of the Turkish IT sector in 2019 was listed as follows:

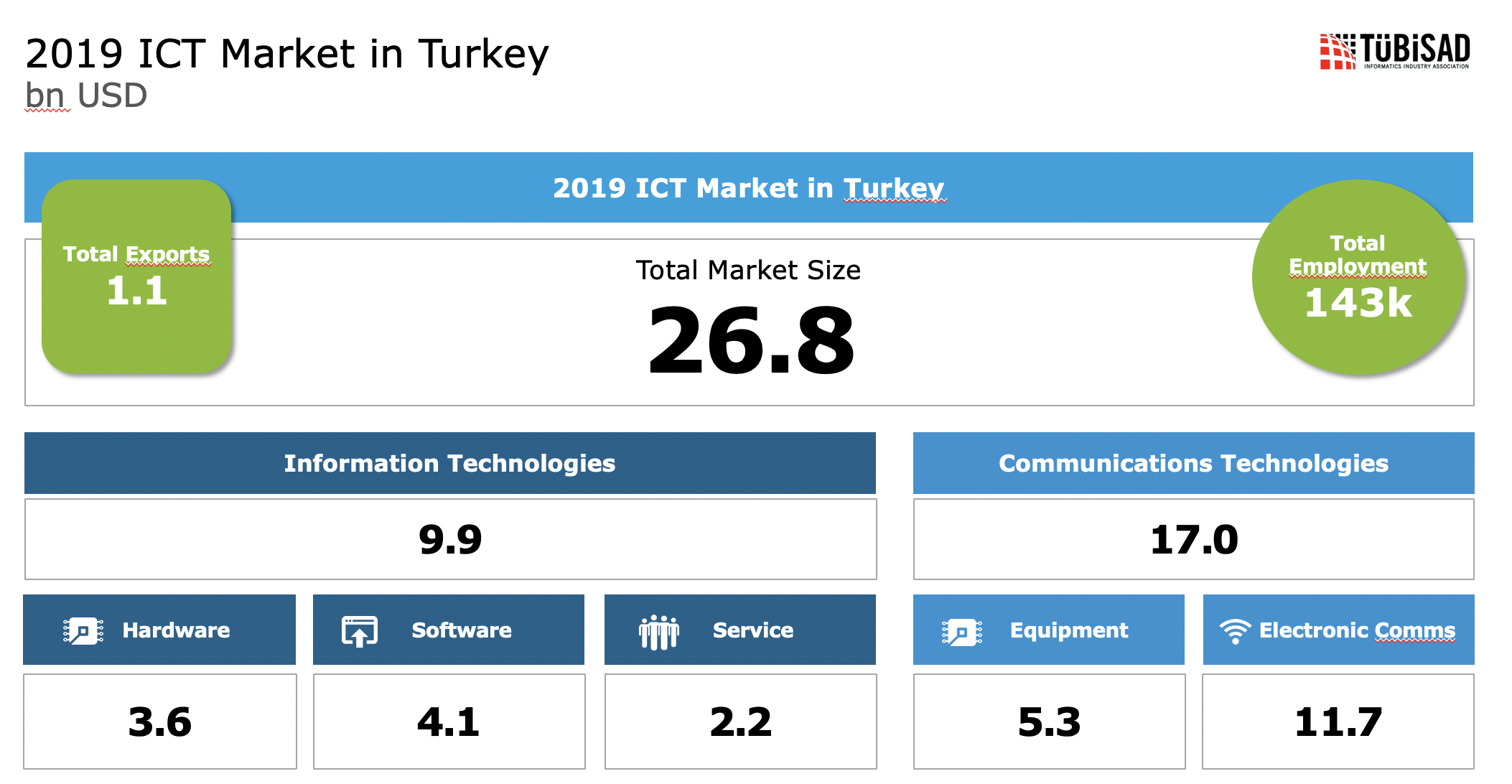

Information and Communication Technologies total sector size reached a volume of 152.7 billion TL in 2019 with a growth of 14 percent on the basis of Turkish Lira. When evaluated on US dollar basis, the size of the sector was $26.8 billion, with a constriction of 3 percent compared to the previous year.

Information technologies, one of the two main elements of the total sector size, reached 56.1 billion TL in 2019 with 22 percent growth on the basis of Turkish Lira, while Communication Technologies reached 96.6 billion TL with 11 percent growth.

Information Technologies :

The sizes in the sub-categories of the Information Technologies sector, which reached 56.1 billion TL in 2019, were as follows:

Information Technology Hardware: 20.4 billion TL

Information Technology Software: 23.4 billion TL

Information Technology Service: 12.2 billion TL

Communication Technologies:

The Communication Technologies sector had a size of 96.6 billion TL in 2019. The distribution of subcategories was as follows:

Communication Technologies Hardware: 29.9 billion TL

Communication Technologies Electronic Communication: 66.6 billion TL

Origin of Products and Services:

While 81 percent of the services and 69 percent of the software produced in the Information Technology sector was of domestic origin, 83 percent of information technology hardware and 84 percent of communication technology hardware were of imported origin.

Employment

In 2019, the total employment of the sector increased to 143,000 people. There was a 4 percent increase in total employment. 77 percent of the total employment of the sector is in the Information Technology category.

Technocities

Growth continued in technocities, in 2019, turnover in technocities increased by 43 percent compared to the previous year and reached 22.9 billion TL. In 2019, 14 percent of the total sector volume was created in technocities.

Export

The export performance of the sector was 6.5 billion TL with 27 percent growth on the basis of TL, while in 2019, exports totaled $1.1 billion, an increase of 8 percent on the basis of USD compared to the previous year. 75 percent of the total exports were made to European Union countries. In order to increase export performance, in addition to increasing the corporate capacities of technology companies, market diversity activities need to be supported.

Sectors that will have the most impact in the next five years

TÜBİSAD’s "Information and Communication Technology Sector 2019 Market Data" Report also included the expectations and predictions of ICT companies. According to the report, company representatives listed the technological areas that will have an impact on the sector over the next five years as follows:

Cloud Technology, AI, Digital Transformation, Analytics/Big Data, Cyber Security, Modernization of Legacy Systems, Blockchain, Emerging Technologies (3D printers, virtual reality, etc.).

For the full report: http://www.tubisad.org.tr/en/images/pdf/tubisad_ict_2020.pdf